The ‘profit warning’ is a counterintuitive concept in the modern corporate world. Seems a bit like the idea of a well-signed, buried treasure-related trip hazard, or the threat of sudden and unexpected happiness.

But it means the opposite of all that: and, as we now know, even the most ‘bankable’ of automotive brands can be vulnerable to one. Few brands in the automotive industry have flexed quite as much profit-making power since the turn of the 21st century as Porsche.

The choppier waters it has hit of late have been attributed to the decline of the Chinese market and the impact of North American tariffs. And it has all been reported – rather a lot – because the idea of a Porsche that isn’t making lorry loads of cash is clearly a tough concept for the market to wrap its head around.

But let’s put these ‘troubled times’ into proper perspective. In 2022, Porsche hit the stock market, and it was a move that made its cash-generating capacities a matter of public concern.

![]()

And since then the brand has made – wait for it – €14 billion for its shareholders.So what has caused all the teeth-gnashing and hand-wringing among the financial press? The ‘problem’, such as it is, is that the company might only manage to make a paltry €1 billion in 2025.

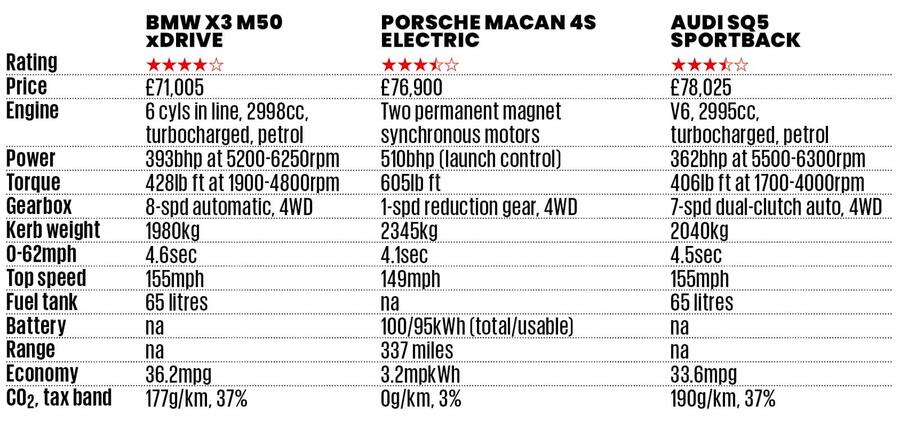

Violins at the ready, then. In 2024 – the year in which the Porsche Macan Electric was launched – Porsche declared roughly 40% more profit than JLR (although these figures are accounted for over different time periods in the UK than in Europe, so that’s not an exact comparison) and more than twice as much money as Ferrari.

Perhaps most importantly of all, the sales performance of Zuffenhausen’s newest all-electric product now seems to be picking up. The Macan was the most popular of all of Porsche’s models in the first half of this year, when ICE and electric model sales are combined.

Sales of the electric version exceeded those of the petrol-fuelled version – as well as those of the 911 sports car. Not bad going, then, and quite contrary to what you might have heard.

Join the debate

Add your comment

The Audi still looks 20 years-old, and is still working that VAG V-6? Good lord, they have the DNWC. Plus, those passenger screens from Jeep? WTF? What passenger needs a screen when you have your phone IN YOUR HAND? Plus, VAG seems to seriously own BASF Plastics. Audi and Porsche are doubling down on the piano black. Piano black is "Convinging Tactile Quality?" Yeah, the X3 is trying to be a German Trance Disco, but piano black is just a sellout. VAG is crap now. BTW, Porsche has lost 96% of its value. Get your figures right and stop favoring Porsche.

Also a good point.

When I were a lad, a Ford Sierra was considered a perfectly adequate family car, and they were a lot smaller and lighter than any of these.

Somehow I've managed to bring up two kids and never needed an SUV.

We've become spoiled and entitled, we really have.

The electric Macan is notoriously spec-sensitive, so it would be good to know more about its configuration. Presumably this one doesn't have air suspension or rear wheel steering - those two additions, plus smaller wheels, might transform it.

Of course, none of this matters for those of us keeping an eye on used EV prices, because most UK buyers speccing a new car make bad choices.

It doesn't matter how many times Autocar recommend VW's adaptive dampers as an essential option, for example - try finding a used Golf GTI with that option.

Most used Macans in the UK will feature the largest wheels and cheapest suspension, and be sub-optimal as a result.

Absolutely, it should have been mentioned on the ( very long ) article. Especially since that seems to be the main reason the Turbo was so poorly received.

Also, as a side bar, 22s? GTFO. Doesn't matter what you do with the setup, you pick those wheels the ride is going to be awful

scrap is right. Autocar should drive a 2wd Macan EV with air suspension and smaller wheels. It's 0-60 time doesn't start a 4, but it is still quick in the real world with instant response at all speeds. It rides better and is priced closer to the BMW. If a company car lease covers depreciation and servicing, then it is a brilliant car that must be chesper to run than an ICE supermini thanks to cheap tax and off-peak charging. So maybe Porsche aren't so miguided.

Absolutley no one could convince me adaptive dampers are Essential on a Golf Gti.

I'm surprized Autocar said it, if indeed they did.

I don't think this website is really for you mate.

Get your car reviews from some you tube numpty instead, dreaming about a Lambo Urus.

Sorry pal but in no way are adaptive dampers essential for a Golf, does it not come with dampers as standard?

Why are you avoiding proofing your rubbish VW bashing post with insults?